How to get an ADA Compliance Tax Credit for making your website ADA accessible

ADA accessibility is important. And today, even your website has to be accessible to people with disabilities. Everyone deserves to have access to the web. You don’t want your website to be inaccessible to people with disabilities.

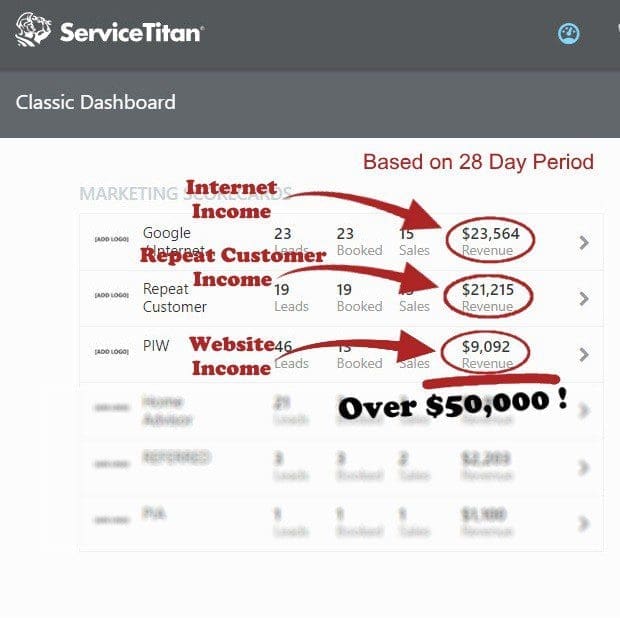

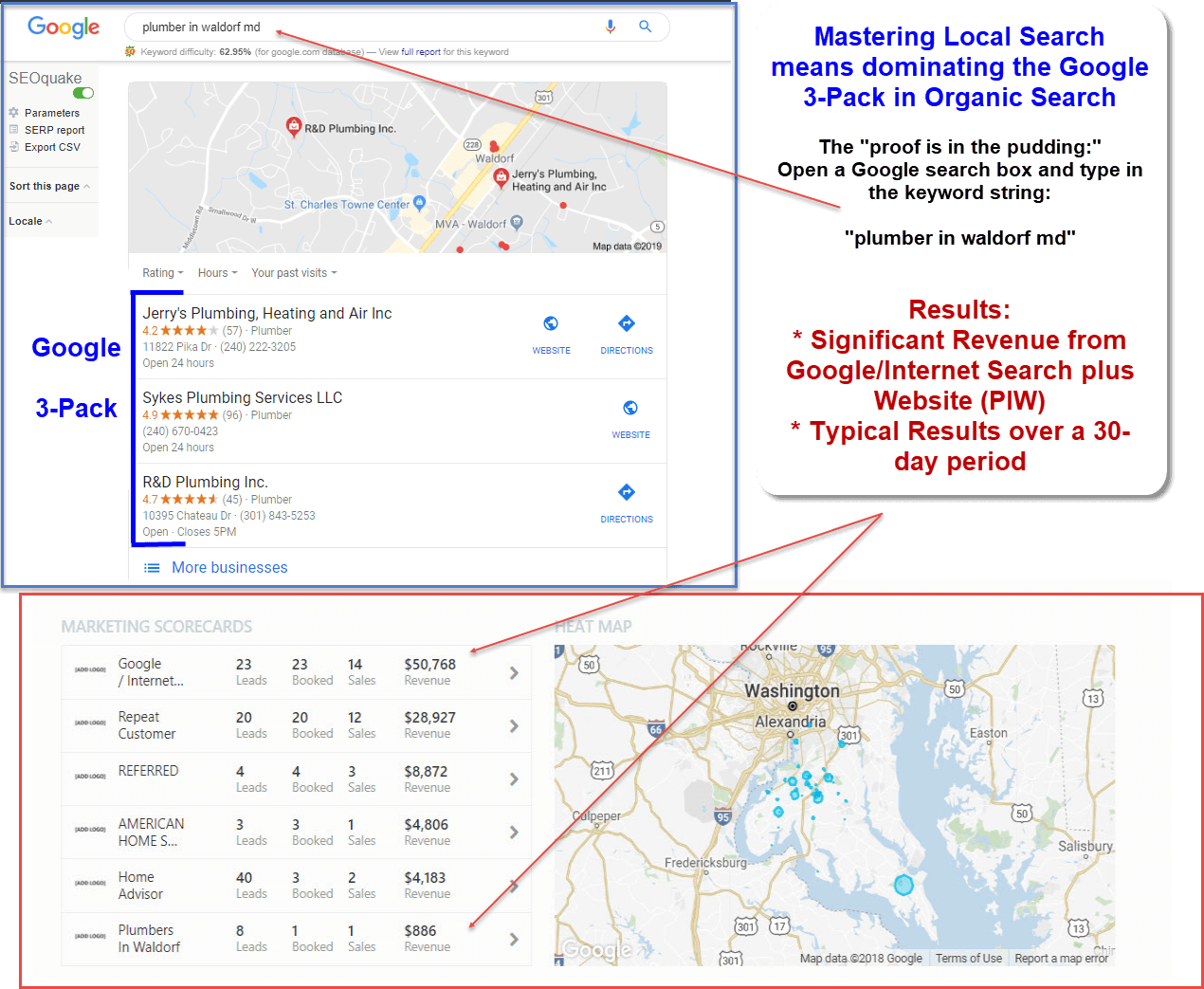

Providing a website for your business is a great way to increase the success of your company.

But, if your website is not ADA compliant, it can be a disadvantage. The problem is that it can be difficult to make your website accessible to everyone – if you don’t know where to begin. Fortunately, we have an easy solution that can make your website ADA accessible by this time tomorrow.

There are many benefits of having an ADA compliant website. It allows people with disabilities to access your website easily, improves user experience, and is typically more cost effective. ADA accessibility is also important for your company because if your website is not compliant, your business risks fines and legal action.

But did you know that you can also get a tax credit for making your website ADA accessible? Most people might think it’s a hassle to get an ADA compliance tax credit. But think again. You deserve a tax credit for making your website ADA compliant.

But did you know that you can also get a tax credit for making your website ADA accessible? Most people might think it’s a hassle to get an ADA compliance tax credit. But think again. You deserve a tax credit for making your website ADA compliant.

In this blog post, I’ll focus on how to get an ADA compliance tax credit for making your website ADA compliant

Why is ADA compliance important?

The Americans with Disabilities Act is a civil rights law that was passed in 1990 that prohibits discrimination against people with disabilities. It ensures that people with disabilities have the same opportunities as people without disabilities. The ADA requires that all entities covered by the act, including businesses, government agencies, and educational institutions, provide accessible websites.

This means that websites must be available to individuals with disabilities, including people who use assistive technologies, so they can access the web. ADA compliance is important because it helps to ensure that people with disabilities can access your website and that you can be sure that your website is accessible to them.

For expenditures more than $250, you can take a 50 percent credit up to $10,250 for a maximum credit of $5000

Tax credits for ADA compliance

“Small businesses incur certain costs when they install a wheelchair ramp, provide a sign language interpreter for an event or offer print materials in braille. Tax benefits for accessibility are meant to help them with these costs. The same tax benefits that apply to accommodations like wheelchair ramps also apply to websites and can help site creators with the associated costs.An ADA compliance tax credit can be used to help offset the cost of running your website.

A tax credit for ADA compliance is a way for a company to reduce the taxes that they owe. If a company is working on making their website ADA compliant, they may be eligible for a tax credit.” – Userway

If your company is looking for ways to cut their taxes, you might want to consider ADA compliance. The Americans with Disabilities Act (ADA) requires that all public accommodations, which includes buildings, websites, and services, be accessible to people with disabilities. This means that you must create an accessible website, and any updates to your website must be made according to this law. By making these updates, you can increase your tax credits for ADA compliance.

But in order to get the tax credit, you must meet certain requirements. For example, you must be in compliance with both the ADA and Section 508 of the Rehabilitation Act of 1973.

Who can get an ADA compliance tax credit?

The Americans with Disabilities Act was created to ensure accessibility for people with disabilities. In order to make your website ADA compliant, you’ll need to make sure that it is as accessible as possible. As I’ve already mentioned, we have an easy solution that can make your website ADA accessible by this time tomorrow.

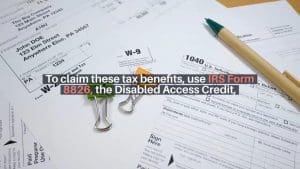

To claim these tax benefits, use IRS form 8826, “The Disabled Access Credit,” and refer to title 26 Internal Revenue Code section 44. The Disabled Access Credit applies to federal taxes.

But wait! There is possibly more!

There may also be additional tax benefits at the state level. You should consult a tax professional or perform additional research depending on the state where your business is based.

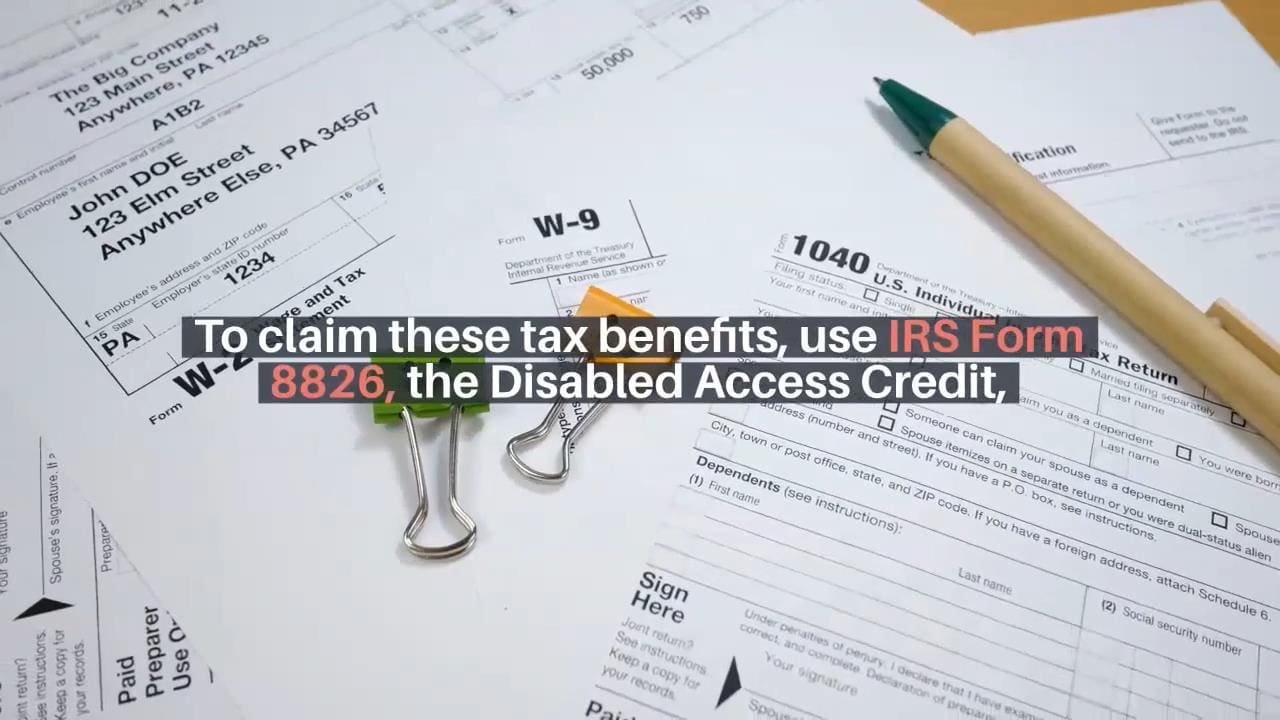

There are certain requirements that have to be met, but if your business qualifies, you are able to get a 50% credit on your qualifying costs.

The disabled access credit is limited to small businesses with gross receipts of $1,000,000 or less or that employ 30 or fewer people. The credit is subtracted outright from taxes owed.

These are the basic terms for claiming the disabled access credit: for expenditures more than $250, you can take a 50 percent credit up to $10,250 for a maximum credit of $5000.

Let me offer you an example: Your company spends $5000 on an accessibility audit or enhancing your website’s accessibility.

Only expenditures more than $250 qualify, so subtract $250 from $5,000 to get $4,750. you can claim 50 percent of that amount as a tax credit.

In other words, you can subtract $2,375 from the tax owed on your next return.

ADA Compliance Tax Credit Summary

The government has created a tax credit to help businesses with ADA compliance costs. Businesses that are ADA-compliant are able to get a tax credit for their expenses related to ADA compliance. With an ADA compliance tax credit, your company can take advantage of the law’s incentives to improve the accessibility of their websites.

ADA compliance is a good idea for any business. Get your website ADA compliant with the help of tax credits. Get started now and take advantage of the tax credit.

Please note that e Internet Marketing Services is not responsible for any tax information that changes or is misinterpreted. We are not tax advisors. This post is meant to be informative and does not replace the advice of an accountant or tax professional.

Click to Learn More

Click to Learn More

0 Comments